Almost a year into the pandemic, Latino-owned businesses (LOBs) are feeling the economic strain. But new research finds some positives despite the difficulties of 2020.

Today marks the release of the State of Latino Entrepreneurship, the annual report from the Stanford Latino Entrepreneurship Initiative (SLEI).

Businesses Across Industries

Marlene Orozco, lead research analyst with SLEI, reminds that the number of Latino business owners has grown 34% over the last 10 years compared to one percent for all other business owners.

“They’re starting businesses across virtually all industries and in many states outside traditional places where people think Latino populations exist. This is important because it’s about changing the narrative,” notes Orozco.

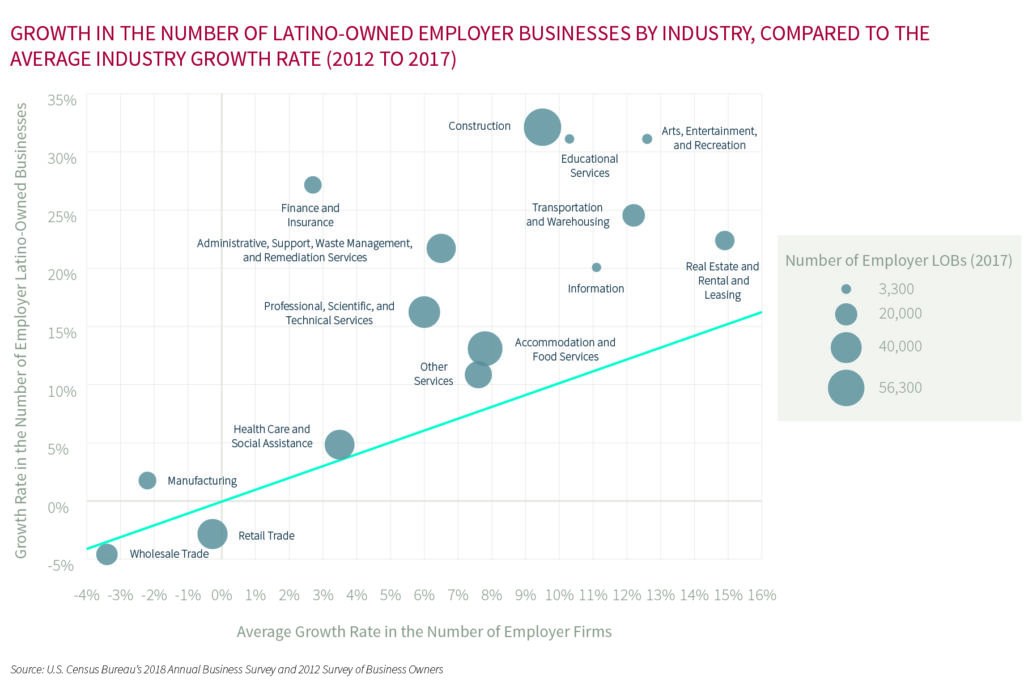

Some sectors that are seeing growth in Latino ownership are construction, insurance, and transportation and warehousing, according to Orozco.

Good Revenue Growth

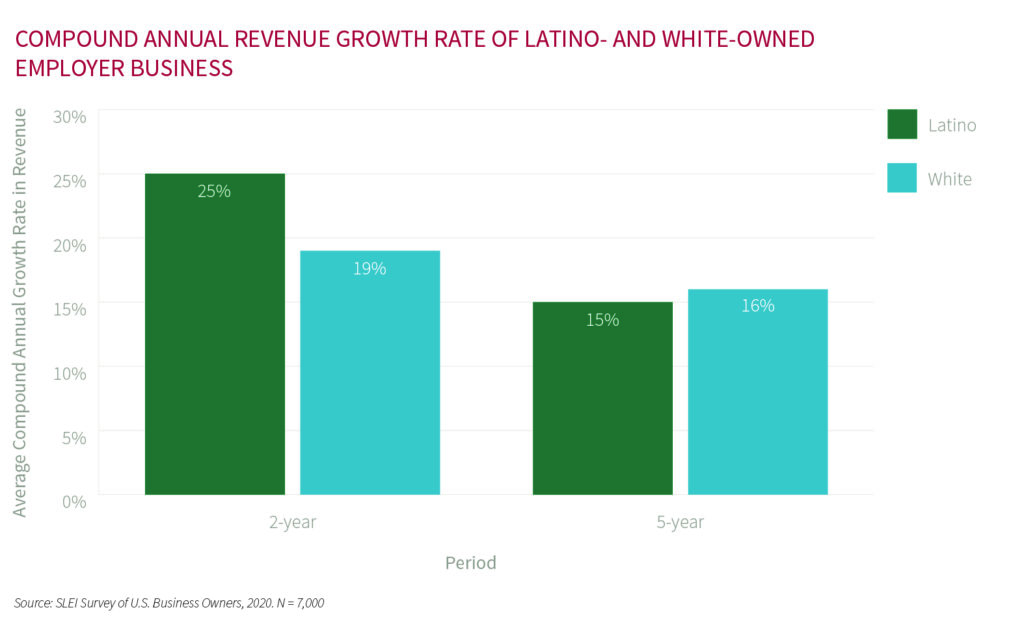

According to the report, LOBs are 60% less likely than White-owned businesses (WOBs) to have loan applications approved by national banks. Orozco says this is what the data reveals even if “we hold the business metrics constant.” She says the businesses may “look the same on paper in terms of revenue growth, profitability, even revenue size.”

Orozco says Latinos have more success obtaining loans from local banks and community banks that are CDFIs or community development financial institutions. But she says national banks should be paying more attention to LOBs.

“Latinos are really ticking off the marks that lenders should be considering. Latinos do not generate as much revenue on average as White businesses do, but if you look at revenue growth year-over-year, we see that a compound annual growth rate for Latinos is actually higher. What really counts here is lenders want to see a track record of revenue growth.”

As it is, Latinos are exposed to more financial risk, says Orozco. “We’re seeing Latinos are more likely to rely on personal credit and putting their personal collateral on the line – their homes and other physical assets.”

In California, Orozco notes there are now pathways for grants. “They’re really looking for some lifelines here with grants and forgivable loans, in particular. Business owners are not paying their vendors. They’re not paying their rent. We’re going to see some immense downstream effects.”

Prioritizing Latina Business Owners

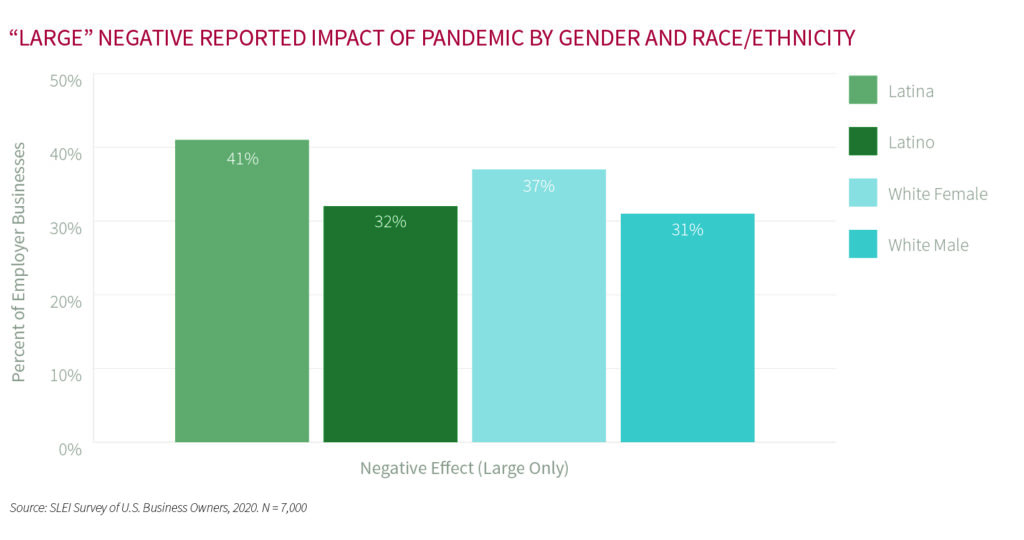

“We found that Latinas have been hardest hit,” says Orozco. “They’re closing their businesses at a higher rate. We’ve seen lots of media stories about the impact of the pandemic on women, particularly those who are mothers. You can imagine that balancing a business from home has been quite the challenge.”

“How do we begin to rebuild and reshape the economy having this segment [of the population] in mind? And prioritizing in that way,” adds Orozco.

She calls out the importance of introducing business owners to resources and “continuing the important role that organizations play in connecting entrepreneurs to capital providers before they’re even needed.”

Part of the Community, Not Just a Business

Originally, David Favela and family members thought about making beer for themselves, but they quickly discovered there was a demand in their San Diego community. “We decided to use our own treasure chest of culture and traditions to inspire our beer making. What about the flavors we like? And can we combine them with craft brewing?”

Favela, CEO and founder of Border X Brewing, says the first beer was inspired by childhood memories. “All of us, as children, have grown up with our aunts, grandma, and mother who were making agua de jamaica, a very traditional drink. So we made a beer with the hibiscus flower and agave, and it was delicious.”

Border X Brewing opened its first tasting room in Barrio Logan, a San Diego neighborhood. It quickly became a popular gathering spot featuring local artists and musicians.

Mujeres Brew House is a second San Diego location. Favela’s wife Carmen, the marketing director, came up with the idea to make it a women-focused brewery. The company had already started a brew club for women. “It was this beautiful group of about 60 women who came together, learned about beer over six months, and made their own beer,” says Favela.

“They learned about the technology, the styles, the ingredients, the history, everything in this class that we set up. A lot of our alumni started getting jobs – good-paying jobs at other breweries across San Diego. Eventually, we want to form a nonprofit that is able to access training funds. It’s really been a beautiful thing.”

The brewery has a third tasting room in Bell, near Los Angeles.

Border X Brewing has been weathering the pandemic. Favela says he has been in a unique position because he had a long IT career with Hewlett-Packard before embarking on craft beer making. He was able to use some of his personal funds in the early part of the pandemic. “I did have at least a cushion,” says Favela, but he was reluctant to use up his savings in order to keep the business going.

“This last year, if you wanted to survive, you had to put a lot of skin in the game. You couldn’t be an observer. if you were committed before, now you’re really committed. And I was basically at the limit of what I could do.”

Favela was able to obtain a first round of PPP funding through a large bank, but went with a smaller bank for his second application. “I think they’re better positioned to serve Latino and underserved markets. I did it with the CDFI and I think they understood the records, the software, and no hiccups at all. It was actually very streamlined.”

Favela thinks receipt of his funds are imminent and plans to resume brewing so he can open the beer gardens at his three locations as California is allowing, once again, for outdoor service.

Because of the pandemic, Favela’s crew of about 35 employees is now at about 30%. With his next round of funds, he plans to start hiring.

As far as long-term goals, Favela says he is considering distribution. “It is a pretty large investment, not only in canning equipment, but also you have to have an account team or a services team that goes out and services all these customers. We really want to gradually build up our brand awareness and presence. But it is our interest.”

In the meantime, for those who are close to one of the three Border X Brewing locations, there’s abuelita’s chocolate stout, horchata golden stout, and a current favorite, according to Favela. “It’s called pepino sour inspired by fresh cucumber, cut up into slices with lime, and a little bit of chili powder and salt. People love it.”

The research team will be discussing the findings from their annual survey during a virtual forum today at 1 p.m., PST. You can register for the event or join the YouTube Livestream.

Stanford Latino Entrepreneurship Initiative (SLEI) is a research and education collaboration between Stanford University and the Latino Business Action Network (LBAN).