At the beginning of 2008, Dale Peterson was 59 years old, rolling through the first decade of the new century like a boss. A partner, to be precise, working in a successful Manhattan architectural firm, serving Wall Street giants such as Goldman Sachs, Lehman Brothers, and Chase. He was married to a senior administrator at Columbia University, with two kids, a “classic six” apartment uptown and a country house upstate.

By Halloween of that year, however, both the global economy and Peterson’s career turned upside down. As financial markets collapsed, workers on every rung of the economic ladder lost jobs, pensions, savings and homes. Wall Street firms cancelled contracts, revenue in the building and design trades evaporated, and Peterson lost his job. Unemployed two weeks shy of his 60th birthday, he recalls seeing warning signs.

“Still, I was taken aback,” he said. “The rug had been pulled out from under me.”

Retiring Early—And Not by Choice

In a recent survey, nearly 60 percent of American workers said they either plan to work past the age of 65 or don’t plan to retire at all. On the surface, the plan makes sense. A single extra year of employment can boost Social Security payments and allow more time to accumulate savings, while also shrinking the length of the retirement period those resources need to cover.

In reality, however, many people may not get to choose their retirement date. The median retirement age in the U.S. today is 62, and roughly half of the 65-year-olds surveyed in 2012 said they left work before they were ready. Of those early retirees, 16 percent said that they had lost their jobs, and 47 percent said they left for health reasons.

While one might assume that older workers generally enjoy greater job security, recent studies show that men between the ages of 50 and 61 are more likely to lose their jobs than those aged 25-34. And older workers who lose their jobs are between roughly one-third to one-half less likely to find new work within the next year than their younger peers. When unemployment lasts two years or longer, the re-employment outlook for older workers is significantly worse than it is for most other demographic groups.

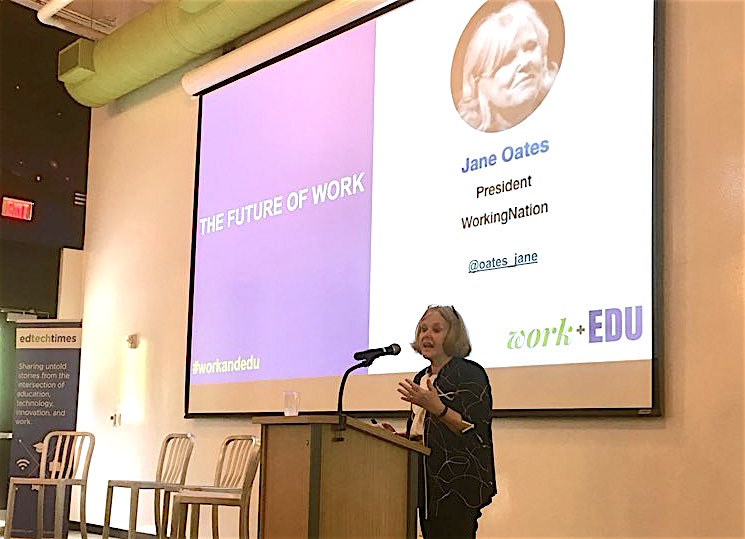

As the Baby Boomers age, the number of older people who need or want to keep working well into their 50s and 60s is going to grow tremendously. WorkingNation believes that retraining older workers to keep their skills relevant is a critical part of keeping people employed as long as they need or want to work. In the meantime, however, it’s important to understand the magnitude of the problem many older workers face. We’ve talked to older people about how their lives have been affected by being forced to consider early retirement. Here are their stories.

Throwing in the Towel

West Michigan native Karen Adkins lost her manufacturing job in 2010, when she was 55. She had a small pension and personal savings, but she knew that even if she could begin collecting Social Security at 62, she should wait as long as possible. When her unemployment benefits stopped after 26 weeks, she turned to a Grand Rapids staffing agency that placed her in a job comparable to her old one, earning slightly more than half her old salary and paying twice as much for benefits.

Since 2005, temporary, on-demand and on-call labor have accounted for much of the nation’s job growth. For older workers, however, the prospect of taking freelance, contract or “gig” work rather than a full-time job means adjusting to lower wages, reduced benefits and limited hopes for promotion. After a few years of fruitless searching for a full-time job, Adkins gave up and accepted early retirement.

“We don’t have kids and have paid off the house, so with a careful budget and some lifestyle compromises, we’re doing better than a lot of other folks I know,” Adkins says. “But emotionally, it’s been a punch in the gut.”

Underemployed and Overqualified

Cate, 57, of Washington, DC, has been underemployed since late 2014. She asked to conceal her last name for fear that speaking out about her struggles might interfere with getting a new job.

When the news-wire service where she worked for nearly 20 years was sold, Cate was shown the door in the ensuing reorganization. Since then, she’s had temporary and part-time gigs, sometimes at a higher hourly wage, but with lower or non-existent benefits and less responsibility.

Recovering her mojo after being laid off “proved to be a very long process, definitely akin to grief.” Cate said. “For the first month I was in shock, and for nearly a year, I struggled with anger, pessimism and sorrow.”

As time passed, friends suggested she consider relocating, but Cate was loathe to leave her church and social circle behind: “That felt like piling loss upon loss,” she said.

Cate continues to look for full-time work, but despite several sets of interviews, her situation remains the same: overqualified and older than her competition. She believes that the current employment model needs to change to value experience just as much as it does youth.

“The current system isn’t serving people well, employees or employers, let alone society as a whole,” she said.

“Shut Out,” But Not Down and Out

Seattle artist and graphic designer Fred Birchman, 63, says he feels “shut out” of the job market despite 30-plus years of professional experience and excellent health. Laid off after 13 years in 2012 when Comcast acquired NBC-Universal, Birchman has since applied for more than 200 open positions as an art director, creative director or senior designer. He’s gotten only one response so far, and not one offer of full-time work.

“You apply for everything online these days and when they run their algorithm, they see all those years of experience and put a big “X” on my file,” he concludes. When required to enter his previous salary, “I put down ‘one dollar’ because I’m willing to negotiate; but I never get that far [in the hiring process].”

He and his wife have been relying on his freelance gigs, her full-time salary, and their savings to get by, and he doesn’t plan to tap Social Security or 401(k) savings for another four to five years. For now the pair live comfortably, and Birchman spends more time making art, caring for his 91-year-old mother, and reconnecting with old friends and mentors. There are benefits to not having full-time work, he says.

“I used to get up at 4 a.m. to spend a couple hours in the studio before commuting to the office,” he says. “I still get up at 4:15 a.m., but now I can take some time with coffee and a newspaper before getting down to work. I am really grateful that I can get so much satisfaction using my hands to work on what I love.”

Finding Success Again

For Dale Peterson, the New York architect, having his career derailed unexpectedly turned out to be the unlucky break he didn’t know he’d been looking for. He’d always cultivated his networking skills and saw them pay off handsomely soon after being dismissed from the private sector. He was introduced to the commissioner of New York City’s Department of Design and Construction and won a great job managing a major new-construction project in the Bronx.

Peterson acknowledges that luck, as much as smarts and his experience, enabled him to resume his career so seamlessly. Approaching 68 now, he looks forward to retiring on his own terms in 2017.

“At 55 or 60, you’re not going to get exactly the same job again. That goes double for salary,” he says. “Don’t wait for the perfect job. Age discrimination is real. Get back in the saddle.”