Technology is changing the way we think about work and education. Jobs are changing. Skills are changing. The Aspen Institute Future of Work Initiative believes it’s time to consider a national plan that will put workers in control of all their future training and education.

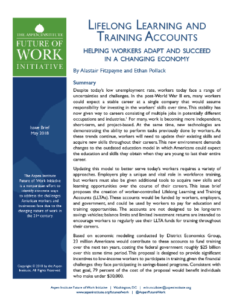

In a new briefing paper, the Future of Work Initiative calls on policymakers to create “tax-advantaged” Lifelong Learning and Training Accounts (LLTC). These accounts would belong to workers and would be portable from job to job. Workers could use the money in the LLTC any time and any way they wanted to pay for education and training.

Under the proposal, beginning at age 18, a person could put as much as $2,000 pre-tax dollars a year into the account, with adjustments to the taxes made based on annual salary.

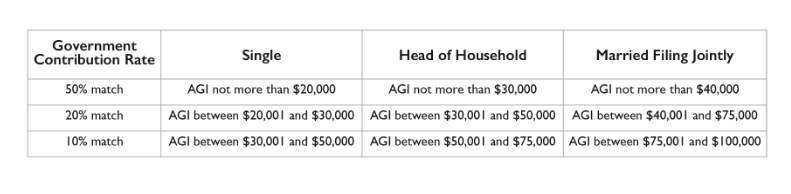

“The government would match individual contributions by providing a direct contribution to these accounts. The rate at which contributions would be matched by the government would decline as income rises,” according to the brief.

The Future of Work Institute argues it is critical for workers to take the lead in their career training because businesses are cutting back on investment in its workers.

“A generation ago, when many employees worked at the same company for their entire careers, an investment in worker training would benefit the worker and the company making the investment,” according to the Aspen Institute.

That model is changing. The brief cites a recent Accenture survey of 1,200 CEOs which shows that over the next three years 74 percent of the executives “plan to use artificial intelligence to automate tasks in their workplace.” Of those same CEOs, just three percent plan to increase investments in training.

RELATED STORY: Penny Pritzker – We need a generation of lifelong learners

The Future of Worker Initiative doesn’t want businesses to walk away completely. It’s also proposed that the government consider creating a business tax credit, similar to the Research and Development credit, to encourage further business investment in worker training.

“Because the benefits of training reside primarily with the worker rather than with the business, there will always be a portion of the investment that benefits the overall economy but not the business itself,” argues the Future of Work proposal. “The result is less investment in training at the same time as the economy requires a more highly-skilled workforce. This underinvestment justifies public policies to make workforce investments less costly and more attractive to employers.”

“We hope this issue brief will help encourage discussion around how workers, employers and government can work together to help workers better manage their economic future.”

You can read more about the Aspen Institute Future of Work Initiative at their website.

Join the Conversation: What do you think about a personal savings account for job training? Share your thoughts on our Facebook page.