Nineteen percent (19%) of the U.S. population – 63 million people – is Latino/as. And their economic contribution is powerful, especially as business creators.

“When we think about Latino-owned businesses, both entrepreneur and employer businesses, we’re talking about almost 5 million Latino entrepreneurs across the country. Out of them, almost a half million are employer businesses,” explains Bárbara Gómez-Aguiñaga, Ph.D., associate director of the Stanford Latino Entrepreneurship Initiative (SLEI) at the Stanford Graduate School of Business.

“With the 5 million businesses, both solopreneurs and employer businesses, they’re generating over $800 billion in annual revenue.”

What’s more, Latino entrepreneurs have been growing at a faster rate in terms of number of businesses started. “When we think about revenue growth, we found that Latino-owned companies have grown at a faster rate in terms of compound annual growth rates. We’ve seen this consistently over the past three or four years,” says Gómez-Aguiñaga.

She adds, “Growth in tech companies that are Latina-owned speaks to a piece of the puzzle that is just representative of the entire Latin entrepreneurial community.”

The State of Latino Entrepreneurship

The impact of Latino-owned businesses (LOB) on the economy and what is driving this critical sector is the subject of the latest State of Latino Entrepreneurship (SOLE) report released today by SLEI at the 2024 State of Latino Entrepreneurship Summit at Stanford University.

Now in its ninth year, the report offers an intersectional perspective, according to Gómez-Aguiñaga.

“We decided to focus on three subgroups that we believe are really important among Latinos. One of them is women, so we’re studying Latinas.

“Another is tech-centric companies because we’ve realized in the past couple of years that Latino entrepreneurs are over-indexing in tech-centric companies. We really wanted to understand what is happening, what is impacting them, what is challenging among them.

“And then the third group is immigrant entrepreneurs. We know that about a third of Latinos are of immigrant descent. We wanted to understand – in the entrepreneurship space – what are the challenges, what are their opportunities.”

The SOLE report explains that this “perspective helps unveil systemic challenges and provides a more accurate and comprehensive understanding of LOBs’ entrepreneurial ecosystem. We focus on employer businesses with at least one employee other than the owner, generating at least $10,000 in annual revenue.”

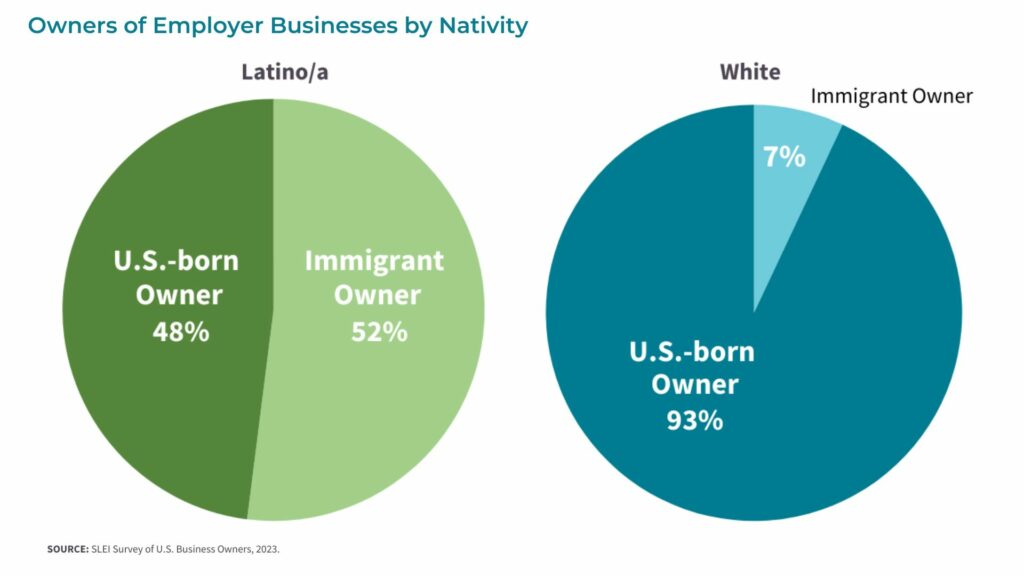

Immigrant Entrepreneurs

“When it comes to entrepreneurship, Latino/a immigrants stand out: Latino/a immigrants over-index in business ownership, representing 52% of all Latino/a-owned firms, compared to just 7% of White-owned businesses (WOB) that are immigrant-owned,” notes the report.

“In general, Latino immigrants in the United States only account for 32% of all U.S. Latinos, but they make up over half of all Latino-owned businesses in the country.

“They bring different perspectives to the table and set different sets of experiences that shape not only their business journey, but also the industry that they choose to engage with,” says Gómez-Aguiñaga.

She also notes, “When we compare Latino immigrant entrepreneurs as well as children of immigrant entrepreneurs and subsequent generations, there is a generational increase in success in terms of revenue and growth.”

According to the report, “While immigrant Latino entrepreneurs primarily operate within consumer-facing industries, children of immigrants and subsequent generations diversify into a broader range of sectors, including B2B (business-to-business) and B2G (business-to-government).

“These trends reveal a nuanced evolution in entrepreneurial focus across generations, highlighting the importance of supporting immigrant-owned ventures to tap into broader markets for enhanced economic impact.”

Tech-centric Entrepreneurs

“With the tech industry, specifically in 2021, we found out that 14% of all non-Hispanic, White-owned employer businesses are related to tech or are in the tech industry – providing services or creating or developing technologies compared to 19% of Latino-owned tech companies,” says Gómez-Aguiñaga.

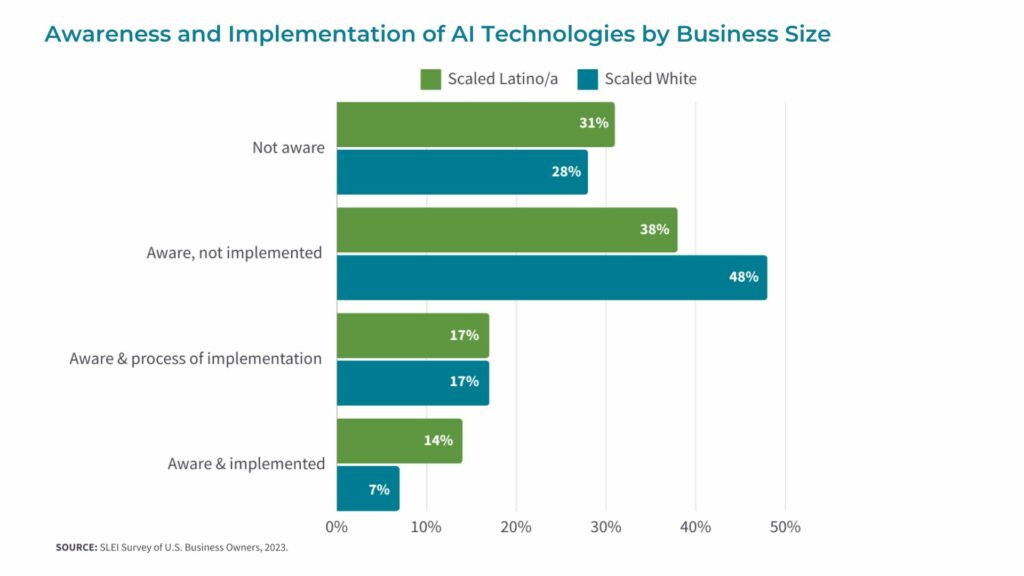

“Latino tech-centric companies are basically using AI technologies for very similar purposes, including data analysis, customer service and support, as well as research. In general, we see a lot more benefits on the use and implementation of AI technologies.”

Gómez-Aguiñaga continues, “Latino-owned tech-centric firms are thriving in terms of growth, revenue, and adoption of AI technologies, but they face other business realities that can impact not just their growth, but also the potential for scaling down the road.”

The report points out, “Nonetheless, tech-centric Latino/a-owned firms face substantive challenges notably in liquidity, access to financing, and contracting hurdles.”

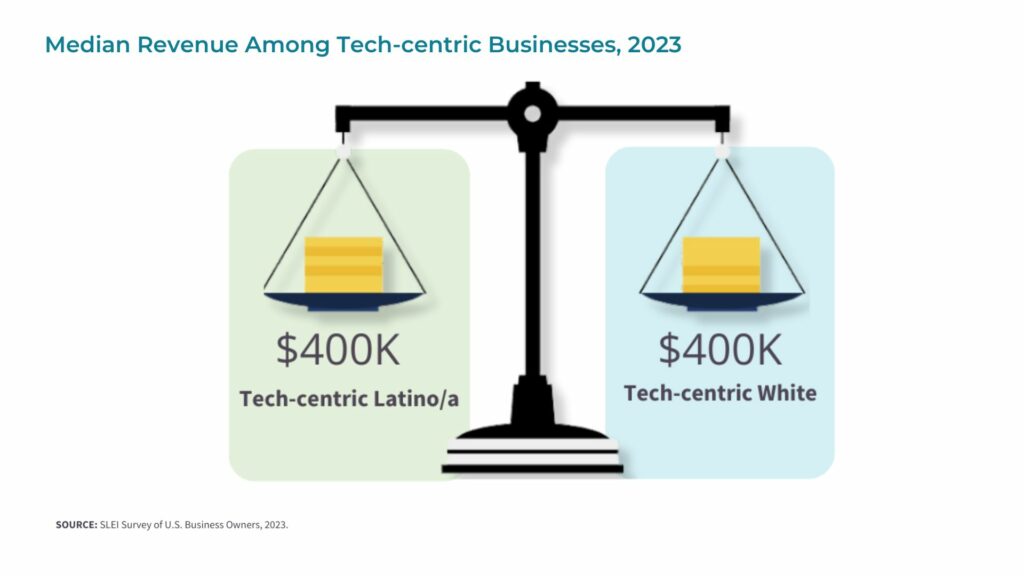

Despite the challenges, Gómez-Aguiñaga says, “We found that Latino-owned companies in tech have very similar revenues as White-owned companies in tech. This is something we haven’t seen ever in the past, but when we dive deeper into the tech-centric firms, it tells you a lot about the growth as well as their resilience and innovation that Latino entrepreneurs are doing in tech.

“Developing ecosystems and communities that support and share resources can help smaller businesses take advantage of AI technologies and foster growth.”

Latina Entrepreneurs

“About 27% of all Latino/Latina-owned businesses are owned by women,” says Gómez-Aguiñaga. “That’s a lot more than non-Hispanic, White businesses where only 21% of all the White-owned businesses are owned by white women.”

The report says, “Regardless of the challenges that Latina-owned businesses face, they demonstrate robust revenue growth, outpacing White female- and White male-owned businesses.

“The growth of female LOBs, however, slightly lags behind male LOBs over the past 3 years with a compound annual growth rate (CAGR) of 9.1% among male LOBs and 7.6% among female LOBs. However, female LOBs marginally surpass the 5-year CAGR of male LOBs with 5.9% among male LOBs and 6.3% female LOBs.”

One of these owners is Mari Borrero, CEO and co-founder of American Abatement and Demo (AAD), based in Auburn, Washington. AAD – around since 2017 – provides “turnkey abatement and demolition services in the local, state, and federal markets,” explains Borrero.

“We started it to help fill a need in our community – helping those coming out of prison with second chance employment. We started off really small – just my husband and myself, and two other people as laborers with him. We started originally in the residential sector. From that, we grew into the commercial and then local, state, and federal.”

Borrero says, “You do your time and then you come back into your community, but there’s all this stigma that follows you and follows myself – just being married to someone that was previously incarcerated – but we weren’t going to let that get us down.”

Despite Growing at a Fast Rate, There are Funding Challenges

According to the report, “Latina-owned businesses … experience the lowest approval rates on business loans from national and local banks.”

Borrero says, “When we’re talking about access to capital, that’s one of my biggest barriers because banks are like, ‘Well, you grew too fast. And I’m dumbfounded by that.” AAD has 12 to 14 employees with approximately $3 million in annual revenue.

“I feel like, ‘You’ve been training this whole time. You finally get to the level where you can play in the NFL game.’ But all of a sudden, they’re saying, ‘Well, you’re just going to have to watch from the bench while all the action is happening around you.’”

Borrero notes, “I feel like it’s always a moving target over and over and over again. I can see the frustration where you want to just throw in the towel because it seems like there’s no lifeline.”

She continues, “I have an awesome SBA business liaison. She’s above and beyond. But when I’m talking about financing SBA capital, this is capital that’s given to banks. You’re talking about your local banks –SBA lenders that actually live in these smaller banks. I’ve gone to them and asked for help and this or that, and it’s just been one thing after another.”

Contracting Challenges

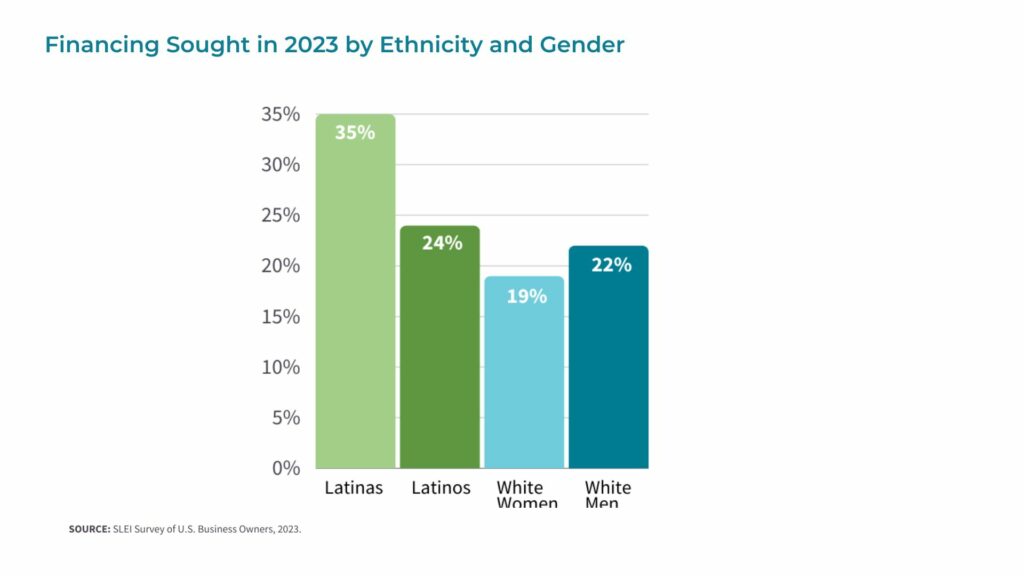

“Mari is a great example of the challenges that women entrepreneurs face not only in accessing capital, but access to contracts, as well,” says Gómez-Aguiñaga. “When we think about contracting opportunities for Latina employer businesses, quite frankly, these trends are very revealing and concerning.

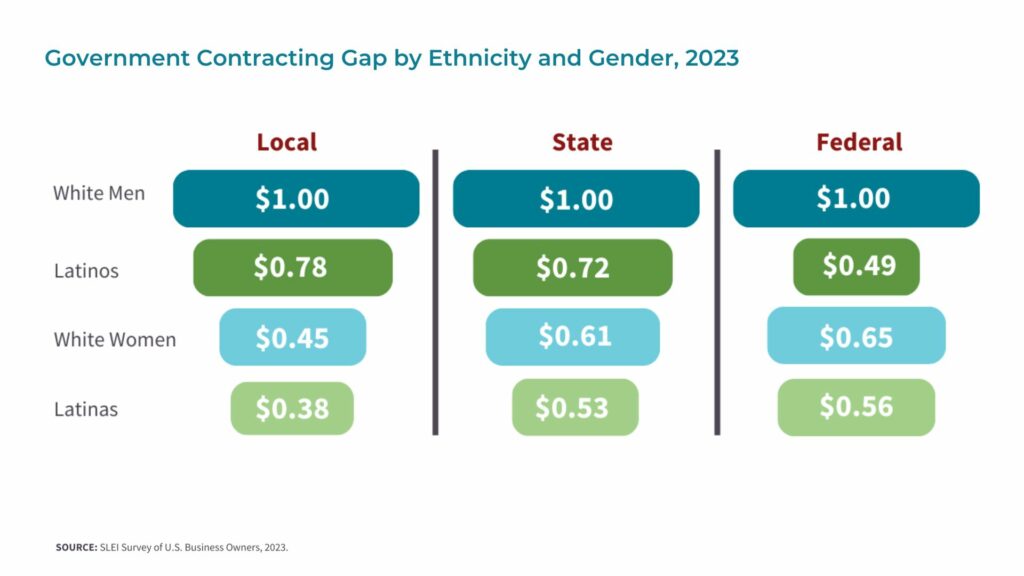

“To begin, Latina-owned businesses engaged in government contracting opportunities at lower rates than their male counterparts. And this is Latinas as well as white women. But when Latinas actually decide to seek contracts, they actually are the least likely to secure contracts. These contracts, at the same time, are the smallest. Our analysis revealed that Latina-owned, employer businesses are almost three times less likely to secure government or corporate contracts than businesses owned by white men. And this is among those that actually are pursuing contracts.”

She adds, “When Latinas are able to secure contracts, they earn only 38 cents to 56 cents in contract revenue for every dollar that a white man earns from contracts. We’re talking about local, state, and federal contracts.”

Borrero is able to cite a less difficult experience as the recipient of a sole-source contract – a contract that can be issued without a competitive bidding process. “That one was less painful in the sense that – I got the call and it’s kind of quick. They usually come at the end of the government quarter. They have to use the money, or they lose it. You’ve got to be agile. You’ve got to be quick.”

Last year, AAD was tasked with cleanup after the Hurricane Ridge Day Lodge in Washington State’s Olympic National Park burned down while closed for renovations.

Borrero says the contract came her way through the SBA’s 8(a) business development program – intended for “small business owners who are socially and economically disadvantaged.”

‘It really does take a village’

When asked about her support network, Borrero credits God, her parents, and the mentors who have helped her along the way.

Regarding the Olympia National Park contract, she says, “They had a really strict timeline, and I was like, ‘Okay, I can figure this out. Who do I have in my network that can help me facilitate this quick?’”

As veteran of the United States Marine Corps, Borrero says, “I feel like the military gave me that skill – adapt and overcome. What’s happening here in this moment? How can I pivot? How does it impact my business? What can I glean from this move on to the next?”

Borrero doesn’t hesitate to make mention of some who have provided mentorship including Hensel Phelps, Saybr Contractors, Inc., and Dickson Company.

The Strength of Ecosystems

When it comes to community, Gómez-Aguiñaga explains, “Ecosystems are important. Obviously, if you are a part of a community that understands your challenges and opportunities, that could help see what others are doing to succeed, see what things you can incorporate to increase growth, increase the staff, and so on. I believe that developing an ecosystem – it’s crucial for minority entrepreneurs, but also Latino employer businesses.”

Borrero echoes the thoughts, “We live in a society that’s so divisive and not collaborative at all, right? It’s ‘us versus them,’ or ‘we’re better than them’. It’s crazy because collaboratively we can accomplish so much more.

“I’ve mentored other small business owners. I’ve gotten them to look at entrepreneurship as a way of changing their lives.”

As the mother of children who are now active in the business, Borrero is also reaching out to young people, “I’m hoping now – in collaboration with the Boys and Girls Club of King County and also with other organizations – to help my community. We’re taking young students, 18 to 26, and trying to be a mentor.”

As her conversation with WorkingNation winds down, Borrero shares exciting news. “I was able to get admitted into the Texas A&M Law School for a certificate program in real estate and construction law. I feel like contracts and construction are a place that needs a lot of education for small minority owners.”

“We can do better in this contracting language that excludes us from being able to be on these contracts. The specifications that are written in these contracts have language that purposely excludes us. So, I have got to learn that lens so I can learn the language.”

Borrero will be studying in the Master of Legal Studies program during the upcoming summer term.

She wraps up, “I’m happy with who I am right now. I know that I’m better than I was five years ago, and the same for my husband. But we’re even more excited about who we are continuing to grow –professionally and personally – five years from now.

“We’re not stuck in the past. We’re not stuck in this moment. We’re not stuck in defeat. We look forward to being a better version of ourselves in the future.”

SOLE is a publication of the Stanford Graduate School of Business in collaboration with the Latino Business Action Network.

You can read the full State of Latino Entrepreneurship here.